New Developments for Advanced Ceramics

In the late 1980s, the advanced ceramics industry was hyped with “ceramic fever”, with structural markets projected to reach billions of dollars in a short period of time. However, this rapid growth failed to occur, due in part to the shelving of certain defense programs, including ceramic armor, as a result of massive cuts in military spending. The proposed automotive engine markets also failed to take off, and other ceramic market segments lost ground simply because newer technologies emerged that no longer required ceramics.

In 2004, the large-scale commercialization of advanced ceramics finally began to shift in a new direction. New technologies emerged for the production of pure and fine advanced ceramic powders with tailored size distributions, which have helped improve the quality of ceramic components. Advanced ceramics manufacturers have scaled up production processes, and new applications have emerged for high-end ceramic products, especially in the military. Additionally, several nanoceramic powders have recently been commercialized and are finding applications in the emerging field of nanotechnology.

All of these developments point to new growth opportunities for structural ceramics, electronic ceramics, high-performance coatings and chemical/environmental ceramics in the years ahead.

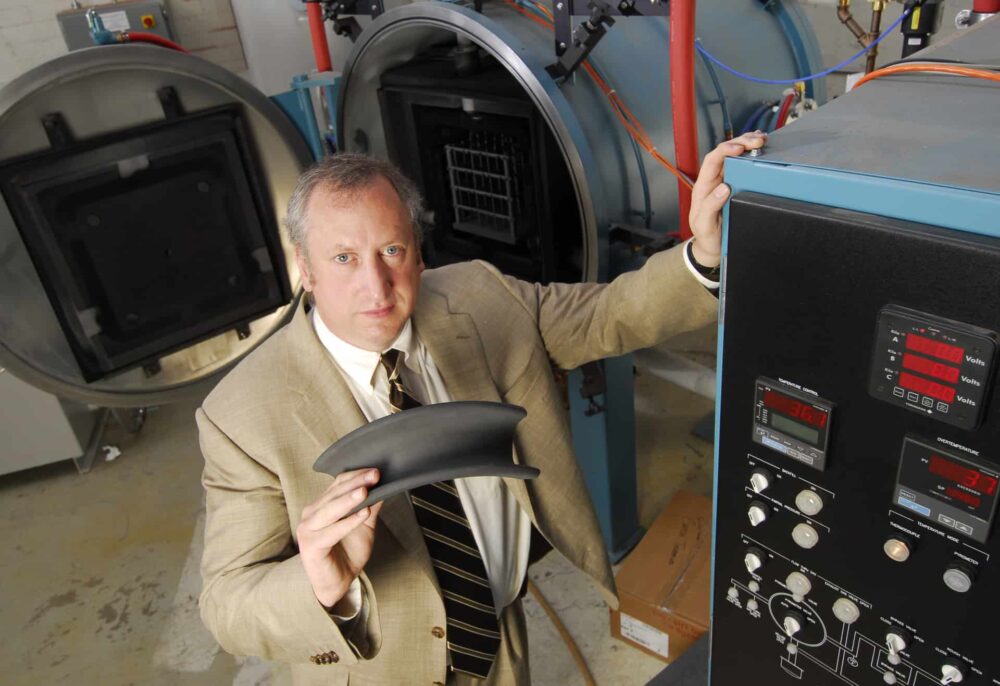

Structural ceramics are seeing a strong growth rate due to the increased demand for ceramic armor for personal protection and military vehicles. In 2004 alone, companies such as Ceradyne, Cercom, Armor Holdings/Simula and ArmorWorks delivered armor worth over $200 million to the U.S. military. More than half a billion dollars worth of orders are currently pending, subject to the allocation of funds by the military. These orders are expected to be executed in 2005 and 2006, and still more orders are expected in the future. Business Communications Co. (BCC) forecasts that the structural ceramics market will double in size from $650 million in 2004 to $1.3 billion by 2009, largely due to the continued boom in armor demand.

Electronic ceramics constitutes a mature market, but some of its segments are also growing strongly. Although growth in the commercial sector has fallen short of earlier projections, military demand has helped boost segments such as piezoelectric ceramics, magnets and semiconductor packages. Overall, the electronic ceramics market segments maintained about a 6% growth rate from 2003 to 2004, and BCC projects that these markets will grow 7.5% annually from 2004 to 2009.

The 2004 market for high-performance ceramic coatings and services was estimated at $1.1 billion. This is expected to increase to $1.6 billion by 2009, at an average annual growth rate (AAGR) of 7.6%. The market for thermal spray coatings dominates the total market and will continue to do so in 2009, as it grows at an AAGR of 8.6% through the forecast period. This high growth rate is due to increased demand for commercial and military aircraft over the next five years. Many airlines in the U.S. are acquiring new aircraft, and demand is increasing in Asia as well. The share of physical vapor deposition (PVD) and chemical vapor deposition (CVD) in the total market will vary little, as the respective markets grow at AAGRs of 5.8% and 5.0% through the forecast period. The market for other coating techniques, including spraying/ dipping, sol gel, micro-oxidation and laser-assisted, is expected to grow at an AAGR of 8.6%.

Due to the new regulations for automobile emissions and hot industrial gases, ceramic automotive catalyst supports and filters are being increasingly used to reduce pollutants from these emissions. Along with ceramic filters and membranes, these markets are expected to remain steady. Overall, the market for chemical processing and environmental-related ceramics reached about $1.7 billion in 2004 and is projected to reach $2.3 billion by 2009, with a growth rate of 7% annually.

Electronic ceramics continue to hold the largest share of the market, at about 64%. However, structural ceramics will experience the fastest growth rate, with 15% annually from 2004-2009. The total value of the U.S. advanced ceramic components market for 2004 is estimated to be $9.5 billion. This will increase to $13.9 billion by 2009, with an AAGR of 8%.